Back in 2010, Kyle Conroy wrote a blogpost entitled, What if I had bought Apple stock instead?:

Currently, Apple’s stock is at an all time high. A share today is worth over 40 times its value seven years ago. So, how much would you have today if you purchased stock instead of an Apple product? See for yourself in the table below.

Conroy kept the post up-to-date until April 1, 2012; at that point, my first Apple computer, a 2003 12″ iBook, which cost $1,099 on October 22, 2003, would have been worth $57,900. Today it would be worth $311,973.

I thought of this meme, which pops up every time Apple’s stock hits a new all-time high, while considering the price Apple paid for P.A. Semi back in 2008; for a mere $278 million the company acquired the talent and IP foundation that would undergird its A-series of chips, which have powered every iPad and every iPhone since 2010, and, before the end of the year, at least one Mac (the rest of the line will follow within two years).

So I was curious: what would $278 million in 2008 Apple stock look like today? The answer is $5.5 billion, which, honestly, is still an absolute bargain, and a reminder that the size of an acquisition is not necessarily correlated with its impact.

Nvidia Acquires ARM

Over the weekend Nvidia consummated the biggest chip deal in history when it acquired Arm1 from Softbank for around $40 billion in stock and cash. Nvidia founder and CEO Jensen Huang wrote in a letter to Nvidia employees:

We are joining arms with Arm to create the leading computing company for the age of AI. AI is the most powerful technology force of our time. Learning from data, AI supercomputers can write software no human can. Amazingly, AI software can perceive its environment, infer the best plan, and act intelligently. This new form of software will expand computing to every corner of the globe. Someday, trillions of computers running AI will create a new internet — the internet-of-things — thousands of times bigger than today’s internet-of-people. Uniting NVIDIA’s AI computing with the vast reach of Arm’s CPU, we will engage the giant AI opportunity ahead and advance computing from the cloud, smartphones, PCs, self-driving cars, robotics, 5G, and IoT.

These are big ambitions for a big purchase, and Wall Street apparently agrees; yesterday Nvidia’s market cap increased by $17.5 billion, nearly covering the $21.5 billion in shares Nvidia will give Softbank in the deal. Indeed, it is Nvidia’s stock that is probably the single most important factor in this deal. Back in 2016, when Softbank acquired Arm, Nvidia was worth about $34 billion; after yesterday’s run-up, the company’s marketcap was $318 billion.

The first takeaway is that selling Arm for $32 billion means that the company was yet another terrible investment by Softbank; simply buying Nvidia shares — or, for that matter, an S&P 500 index fund, which is up 55% since then — would have provided a much better return than the ~5% Softbank earned from Arm.

The second takeaway is the inverse: Nvidia is acquiring a company that was its marketcap peer four years ago for a relative pittance. Granted, Nvidia’s stock may not stay at its current lofty height — the company has a price-to-earnings ratio of over 67, well above the industry average of 27 — but that is precisely why a majority-stock acquisition makes sense; Nvidia’s stock may retreat, but Arm will still be theirs.

Nvidia’s Integration

Beginning my analysis with stock prices is not normally what I do; I’m generally more concerned with the strategies and business models of which stock price is a result, not a driver. The truth, though, is that once you start digging into the details of Nvidia and ARM, it is rather difficult to see what strategy might be driving this acquisition.

Start with Nvidia: the company is perhaps the shining example of the industry transformation wrought by TSMC; freed of the need to manufacture its own chips, Nvidia was focused from the beginning on graphics. Its TNT cards, released in the late 1990s, provided 3D graphics for games while also powering Windows (previously hardware 3D graphics were only available via add-on cards); its GeForce line, released in 1999, put Nvidia firmly at the forefront of the industry, a position it retains today.

It was in 2001 that Nvidia released the GeForce 3, which had the first pixel shader; instead of a hard-coded GPU that could only execute a pre-defined list of commands, a shader was software, which meant it could be programmed on the fly. This increased level of abstraction meant the underlying graphics processing unit could be much simpler, which meant that a graphics chip could have many more of them. The most advanced versions of Nvidia’s just-announced GeForce RTX 30 Series, for example, has an incredible 10,496 cores.

This level of scalability makes sense for video cards because graphics processing is embarrassingly parallel: a screen can be divided up into an arbitrary number of sections, and each section computed individually, all at the same time. This means that performance scales horizontally, which is to say that every additional core increases performance.

It turns out, though, that graphics are not the only embarrassingly parallel problem in computing. Another obvious example is encryption: brute forcing a key entails running the exact same calculation over-and-over again; the chips doing the calculation don’t need to be complex, they simply need as many cores as possible (this is why graphics cards are very popular for blockchain applications; miners are basically endlessly brute-forcing encryption keys).

What is most enticing for Nvidia, though, is machine learning. Training on large datasets is an embarrassingly parallel problem, which means it is well-suited for graphics cards. The trick, though, is in decomposing a machine learning algorithm into pieces that can be run in parallel; graphics cards were designed for, well, graphics, which meant that programmers had to work in graphics programming languages like OpenGL.

This is why Nvidia transformed itself from a modular component maker to an integrated maker of hardware and software; the former were its video cards, and the latter was a platform called CUDA. The CUDA platform allows programmers to access the parallel processing power of Nvidia’s video cards via a wide number of languages, without needing to understand how to program graphics.

Here the kicker: CUDA is free, but that is because the integration is so tight. CUDA only works with Nvidia video cards, in large part because many of the routines are hand-tuned and optimized. It is a tremendous investment that has paid off in a major way: CUDA is dominant in machine learning, and Nvidia graphics cards cost hundreds of dollars ($1500 in the case of the aforementioned RTX 3090). Apple isn’t the only company that understands the power of differentiating premium hardware with software.

Arm’s Neutrality

Arm’s business model could not be more different. The company, founded in 1990 as a joint venture between Acorn Computers, Apple, and VLSI Technology, doesn’t sell any chips of its own; rather, it licenses chip designs to companies which actually manufacture ARM chips. Except even that isn’t quite right: most ARM licensees actually contract with manufacturers like TSMC to make physical chips, which are then sold to OEMs. The entire ecosystem is extremely modular; consider an Oppo smartphone, with a MediaTek chip:

Arm chips appear in many more devices than smartphones — most micro-controllers in embedded systems are Arm designs — and Arm designs more than CPUs; the company’s catalog includes everything from GPUs to AI accelerator chips. It also licenses less than full designs: Apple, for example, designs its own chips, but uses the ARM Instruction Set Architecture (ISA) to communicate with them. The ARM ISA is the platform that ties this entire ecosystem together; programs written for one ARM chip will run on all ARM chips, and each of those chips results in a licensing fee for Arm.

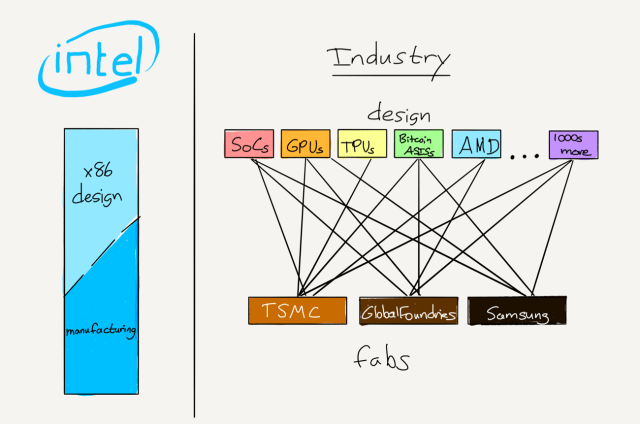

What makes Arm’s privileged position viable is the same one that undergirds TSMC’s: neutrality. I wrote about the latter in Intel and the Danger of Integration:

In 1987, Morris Chang founded Taiwan Semiconductor Manufacturing Company (TSMC) promising “Integrity, commitment, innovation, and customer trust”. Integrity and customer trust referred to Chang’s commitment that TSMC would never compete with its customers with its own designs: the company would focus on nothing but manufacturing.

This was a completely novel idea: at that time all chip manufacturing was integrated a la Intel; the few firms that were only focused on chip design had to scrap for excess capacity at Integrated Device Manufacturers (IDMs) who were liable to steal designs and cut off production in favor of their own chips if demand rose. Now TSMC offered a much more attractive alternative, even if their manufacturing capabilities were behind.

In time, though, TSMC got better, in large part because it had no choice: soon its manufacturing capabilities were only one step behind industry standards, and within a decade had caught-up (although Intel remained ahead of everyone). Meanwhile, the fact that TSMC existed created the conditions for an explosion in “fabless” chip companies that focused on nothing but design.

For example, in the late 1990s there was an explosion in companies focused on dedicated graphics chips: nearly all of them were manufactured by TSMC. And, all along, the increased business let TSMC invest even more in its manufacturing capabilities.

That article was about TSMC overtaking Intel in fabrication, but a similar story can be told about Arm overtaking Intel in mobile. Intel was relentlessly focused on performance, but smartphones needed to balance performance with battery concerns. Arm, which had been spending years designing highly efficient processors for embedded applications, had both the experience and the business model flexibility to make mobile a priority.

The end result made everyone a winner (except Intel): nearly every smartphone in the world runs on an ARM-derived chip (either directly or, in the case of companies like Apple, the ARM ISA), which is to say that Arm makes money when everyone else in the mobile ecosystem makes money.

The Nvidia-ARM Mismatch

Notice that an ARM license, unlike the CUDA platform, is not free. That makes sense, though: CUDA is a complement to Nvidia’s proprietary graphics cards, which command huge margins. ARM license fees, on the other hand, can and are paid by everyone in the ecosystem, and in return everyone in the ecosystem gets equal access to Arm’s designs and ISA. It’s not free, but it is neutral.

That neutrality is gone under Nvidia ownership, at least in theory: now Nvidia has early access to ARM designs, and the ability to push changes in the ARM ISA; to put it another way, Nvidia is now a supplier for many of the companies it competes with, which is a particular problem given Nvidia’s reputation for both pushing up prices and being difficult to partner with. Here again Apple works as an analogy: the iPhone maker is notorious for holding the line on margins, prioritizing its own interests, and being litigious about intellectual property; Nvidia has the same sort of reputation. So does Intel, for that matter; the common characteristic is being vertically integrated.

Of course Nvidia is insistent that ARM licensees have nothing to worry about. Huang noted in that letter to Nvidia employees:

Arm’s business model is brilliant. We will maintain its open-licensing model and customer neutrality, serving customers in any industry, across the world, and further expand Arm’s IP licensing portfolio with NVIDIA’s world-leading GPU and AI technology.

Notice that last bit: Huang is not only arguing that Nvidia will serve Arm customers neutrally, but that Nvidia itself will adopt Arm’s business model, licensing its IP to competitive chip-makers. It’s as if this is an acquisition in reverse: the $318 billion acquirer is fitting itself into a world defined by its $40 billion acquisition.

Color me skeptical; not only is Nvidia’s entire business predicated on selling high margin chips differentiated by highly integrated software, but Nvidia’s entire approach to the market is about doing what is best for Nvidia, without much concern for partners or, frankly customers. It is a luxury afforded those that are clearly best in class, which by extension means that sharing is anathema; why trade high margins at the top of the market for low margins and the headache of serving everyone?

In short, this deal feels like the inverse of the P.A. Semi deal not simply in terms of the price tag, but in its overall impact on the acquirer. I have a hard time believing that Nvidia is going to change its approach.

Or maybe that’s the entire point.

Huang’s Dream

By far the best articulation of the upside of this deal came, unsurprisingly, from Huang. What was notable about said articulation, though, was that it came 46 minutes into the investor call about the acquisition, and only then in response to a fairly obvious question: why does Nvidia need to own ARM, instead of simply license it (like Apple, which has a perpetual license to the ARM ISA, and is not affected by this acquisition)?

What was so striking about Huang’s answer was not simply its expansiveness — I’ve transcribed the entire answer below — but also the way in which he delivered it; unlike the rest of the call, Huang’s voice was halting and uncertain, as if he were scared of his own ambition. I know this excerpt is long, but it’s essential:

We were delightful licensees of ARM. As you know we used ARM in one of our most important new initiatives, the Bluefield GPU. We used it for the Nintendo Switch — it’s going to be the most popular and success game console in the history of game consoles. So we are enthusiastic ARM licensees.

There are three reasons why we should buy this company, and we should buy it as soon as we can.

Number one is this: as you know, we would love to take Nvidia’s IP through ARM’s network. Unless we were one company, I think the ability for us to do that and to do that with all of our might, is very challenging. I don’t take other people’s products through my channel! I don’t expose my ecosystem to to other company’s products. The ecosystem is hard-earned — it took 30 years for Arm to get here — and so we have an opportunity to offer that whole network, that vast ecosystem of partners and customers Nvidia’s IP. You can do some simple math and the economics there should be very exciting.

Number two, we would like to lean in very hard into the ARM CPU datacenter platform. There’s a fundamental difference between a datacenter CPU core and a datacenter CPU chip and a datacenter CPU platform. We last year decided we would adopt and support the ARM architecture for the full Nvidia stack, and that was a giant commitment. The day we decided to do that we realized this was for as long as we shall live. The reason for that is that once you start supporting the ecosystem you can’t back out. For all the same reasons, when you’re a computing platform company, people depend on you, you have to support them for as long as you shall live, and we do, and we take that promise very seriously.

And so we are about to put the entire might of our company behind this architecture, from the CPU core, to the CPU chips from all of these different customers, all of these different partners, from Ampere or Marvell or Amazon or Fujitsu, the number of companies out there that are considering building ARM CPUs out of their ARM CPU cores is really exciting. The investments that Simon and the team have made in the last four years, while they were out of the public market, has proven to be incredibly valuable, and now we want to lean hard into that, and make ARM a first-class data center platform, from the chips to the GPUs to the DPUs to the software stack, system stack, to all the application stack on top, we want to make it a full out first-class data center platform.

Well, before we do that, it would be great to own it. We’re going to accrue so much value to this architecture in the world of data centers, before we make that gigantic investment and gigantic focus, why don’t we own it. That’s the second reason.

Third reason, we want to go invent the future of cloud to edge. The future of computing where all of these autonomous systems are powered by AI and powered by accelerated computing, all of the things we have been talking about, that future is being invented as we speak, and there are so many great opportunities there. Edge data centers — 5G edge data centers — autonomous machines of all sizes and shapes, autonomous factories, Nvidia has built a lot of software as you guys have seen — Metropolis, Clara, Isaac, Drive, Jarvis, Aerial — all of these platforms are built on top of ARM, and before we go and see the inflection point, wouldn’t it be great if we were one company.

And so the timing is really quite important. We’ve invested so much across all of these different areas, that we felt that we really had to take the opportunity to own the company and collaborate deeply as we invent the future. That’s the answer.

It turns out this is very much an Nvidia vision after all. Nvidia is not setting out to be a partner, someone that gets along with everyone in exchange for a couple of pennies in licensing fees. Quite the opposite: Huang wants to own it all.

In this vision Nvidia’s IP is the CUDA to its graphics chips — the complement to its grander ambitions. Huang has his sights set firmly on Intel, but while Intel has leveraged its integration of design and manufacturing, Nvidia is going to leverage its integration of chip design and software. Huang’s argument is that it is the lack of software — a platform, as opposed to simply a chip or a core — that is limiting ARM in the data center, and that Nvidia intends to build that software.

On one hand, this is exciting for ARM licensees, particularly companies like Amazon that have invested in ARM chips for the data center; note, though, that Nvidia isn’t doing this out of charity. Huang twice mentioned the importance of capturing the upside he believes Nvidia will generate, which ultimately means increased license fees. Sure, Nvidia will be able to make more changes to ARM to suit the data center than they could have as licensor, but the real goal is to tie ARM into an Nvidia software platform until licensees have no choice but to pay what will undoubtedly be ever-increasing licensing fees (which, it should be noted, will still result in chips that less expensive than Intel’s).

I don’t know if it will work; data centers are about the density of processing power, which is related to but still different than performance-per-watt, ARM’s traditional advantage relative to Intel, and there are a huge amount of 3rd-parties involved in such a transition. There is a lot about this vision that is out of Nvidia’s control — it’s more of a dream. What is comforting in a way, though, is just how true this dream is to what makes Nvidia unique: this isn’t about adopting ARM’s approach, it’s about co-opting it for a vision of integration that makes Nvidia an object of inevitability, not affection.

And, to return to the beginning, it is a bet that is a relatively free one. If Nvidia’s stock is over-priced, then it is buying Arm for an even bigger discount than it seems; the vision Huang laid out, though, is a reason to believe Nvidia’s stock price is actually correct. Might as well roll the dice on a P.A. Semi-type outcome.

Three additional notes about this transaction:

- As I noted above, Apple has a perpetual license to ARM. The specific details of this license are unknown — we now know that Apple can extend the ISA for its own uses — but my understanding is that the terms are locked in. That is why Apple didn’t feel any motivation to acquire ARM itself, even if Nvidia, a company that Apple does not get along with, was the alternative suitor.

- This vision of Arm’s future is in many ways incompatible with ARM’s neutral past, but the truth is Arm is already facing disruption of its own. RISC-V is an open-source ISA that is increasingly popular for embedded controllers in particular, in large part because it not only gets rid of Arm control, but also Arm license fees. I would expect investment in RISC-V to accelerate on this news, but it’s worth noting that it is just that — an acceleration of what was inevitable in the long run.

- One of the biggest regulatory questions around this acquisition is China. On one hand, China has reason to fear an American company — which is subject to U.S. export controls — acquiring more processor technology. On the other hand, Arm China is actually a joint venture, the CEO of which has gone rogue; it’s not clear if Arm is actually in control. It’s possible that this acquisition happens without China’s approval and without ARM China, which is 20% of Arm’s sales. Huang’s dream, though, is perhaps enough to justify this nightmare.

Throughout this article I will write “Arm” when I am referring to the company, and “ARM” when I am referring to said company’s IP ↩