So it finally happened: the U.S. Department of Justice has filed a lawsuit against Google, alleging anticompetitive behavior under Section 2 of the Sherman Antitrust Act. And, as far as I can tell, everyone is disappointed in the DOJ’s case; Nilay Patel’s tweets were representative:

If you are Google, you have been batting down most of the DOJ's argument in Europe, which has stronger antitrust laws and more aggressive regulators, for YEARS. This complaint is like a vacation for them.

— nilay patel (@reckless) October 20, 2020

I can’t speak to Barr’s motivations for launching this lawsuit now, although it has been frustrating to see the degree to which antitrust seems to have been politicized, particularly the AT&T-Time Warner case; I can understand the instinctual skepticism and suspicion that this was timed for the election.

That noted, I think the conventional wisdom about the specifics of this lawsuit are mistaken: I believe the particulars of the Justice Department’s complaint have been foreshadowed for a long time, and make for a case stronger than most of Europe’s; if the lawsuit fails in court — as it very well may — it also points to where Congress should act to restrain the largest companies in the world.

Delrahim’s Preview

On June 11, 2019, Assistant Attorney General Makan Delrahim gave a speech to the Antitrust New Frontiers Conference in Israel that laid out the conceptual framework within which this lawsuit fits (Delrahim recused himself from this case specifically as he previously worked on Google’s DoubleClick acquisition). The most interesting part of the speech was focused on the history of antitrust, starting with Standard Oil:

Standard Oil acquired many refineries in the late 19th century. Refiners that would not sell were underpriced and driven out of the market. Price-cutting is the essence of competition, of course, but the Standard Oil case and later Supreme Court cases helped establish what would become settled law: there are some things that a monopolist cannot do. A company does not ordinarily violate the antitrust laws for merely exercising legitimately gained market power. But even if a company achieves monopoly position through legitimate means, it cannot take actions that do not advance plausible business goals but rather are designed to make it harder for competitors to catch up.

Later in the speech Delrahim specifically called out exclusivity agreements as an example of this illegal behavior:

Exclusivity is another important category of potentially anticompetitive conduct. The Antitrust Division has had a long history of analyzing exclusive conduct in traditional industries under both Sections 1 and 2 of the Sherman Act. Generally speaking, an exclusivity agreement is an agreement in which a firm requires its customers to buy exclusively from it, or its suppliers to sell exclusively to it. There are variations of this restraint, such as requirements contracts or volume discounts.

To be sure, in some circumstances, these can be procompetitive, especially where they enable OEMs and retailers to maximize output and overcome free-riding by contractual partners. In digital markets, they can be beneficial to new entrants, particularly in markets characterized by network effects and a dominant incumbent. They also can be anticompetitive, however, where a dominant firm uses exclusive dealing to prevent entry or diminish the ability of rivals to achieve necessary scale, thereby substantially foreclosing competition. This is true in digital markets as well.

As I noted at the time, this speech was clearly a very big deal:

Stepping back, the first and most important takeaway from this speech is that this focus on tech companies does not feel like a top-down directive from President Trump to focus on political enemies (like the AT&T case did). This is a substantive and far-reaching overview of why tech is worthy of being investigated, and my estimate as to whether an antitrust case will happen has increased considerably.

That case was filed yesterday: contrary to the complaints of many Google critics and competitors, including the European Union in the Google Shopping case, it is not focused on the Search Engine Results Pages (SERP), and, contrary to the (still ongoing) investigation from 50 state and territory attorneys general, it is not focused on Google’s ad business. The focus is narrow, and inline with Delrahim’s framework: Google may have earned its position honestly, but it is maintaining it illegally, in large part by paying off distributors.

The DOJ’s Case, and Google’s Response

The core of the DOJ’s argument is at the beginning of the complaint; this excerpt is a bit long, but that is because these five paragraphs contain basically the entire case:

For a general search engine, by far the most effective means of distribution is to be the preset default general search engine for mobile and computer search access points. Even where users can change the default, they rarely do. This leaves the preset default general search engine with de facto exclusivity. As Google itself has recognized, this is particularly true on mobile devices, where defaults are especially sticky.

For years, Google has entered into exclusionary agreements, including tying arrangements, and engaged in anticompetitive conduct to lock up distribution channels and block rivals. Google pays billions of dollars each year to distributors — including popular-device manufacturers such as Apple, LG, Motorola, and Samsung; major U.S. wireless carriers such as AT&T, T-Mobile, and Verizon; and browser developers such as Mozilla, Opera, and UCWeb — to secure default status for its general search engine and, in many cases, to specifically prohibit Google’s counterparties from dealing with Google’s competitors. Some of these agreements also require distributors to take a bundle of Google apps, including its search apps, and feature them on devices in prime positions where consumers are most likely to start their internet searches.

Google has thus foreclosed competition for internet search. General search engine competitors are denied vital distribution, scale, and product recognition—ensuring they have no real chance to challenge Google. Google is so dominant that “Google” is not only a noun to identify the company and the Google search engine but also a verb that means to search the internet.

Google monetizes this search monopoly in the markets for search advertising and general search text advertising, both of which Google has also monopolized for many years. Google uses consumer search queries and consumer information to sell advertising. In the United States, advertisers pay about $40 billion annually to place ads on Google’s search engine results page (SERP). It is these search advertising monopoly revenues that Google “shares” with distributors in return for commitments to favor Google’s search engine. These enormous payments create a strong disincentive for distributors to switch. The payments also raise barriers to entry for rivals—particularly for small, innovative search companies that cannot afford to pay a multi-billion-dollar entry fee. Through these exclusionary payoffs, and the other anticompetitive conduct described below, Google has created continuous and self-reinforcing monopolies in multiple markets.

Google’s anticompetitive practices are especially pernicious because they deny rivals scale to compete effectively. General search services, search advertising, and general search text advertising require complex algorithms that are constantly learning which organic results and ads best respond to user queries; the volume, variety, and velocity of data accelerates the automated learning of search and search advertising algorithms. When asked to name Google’s biggest strength in search, Google’s former CEO explained: “Scale is the key. We just have so much scale in terms of the data we can bring to bear.” By using distribution agreements to lock up scale for itself and deny it to others, Google unlawfully maintains its monopolies.

Google argues that this is “deeply flawed”; from the company’s blog:

The Department’s complaint relies on dubious antitrust arguments to criticize our efforts to make Google Search easily available to people.

Yes, like countless other businesses, we pay to promote our services, just like a cereal brand might pay a supermarket to stock its products at the end of a row or on a shelf at eye level. For digital services, when you first buy a device, it has a kind of home screen “eye level shelf.” On mobile, that shelf is controlled by Apple, as well as companies like AT&T, Verizon, Samsung and LG. On desktop computers, that shelf space is overwhelmingly controlled by Microsoft.

So, we negotiate agreements with many of those companies for eye-level shelf space. But let’s be clear—our competitors are readily available too, if you want to use them…

The bigger point is that people don’t use Google because they have to, they use it because they choose to. This isn’t the dial-up 1990s, when changing services was slow and difficult, and often required you to buy and install software with a CD-ROM. Today, you can easily download your choice of apps or change your default settings in a matter of seconds—faster than you can walk to another aisle in the grocery store.

Or, as Google founder Larry Page was fond of saying, “Competition is only a click away.”

Aggregation Theory

The problem with the vast majority of antitrust complaints about big tech generally, and online services specifically, is that Page is right. You may only have one choice of cable company or phone service or any number of physical goods and real-world services, but on the Internet everything is just zero marginal bits.

That, though, means there is an abundance of data, and Google helps consumers manage that abundance better than anyone. This, in turn, leads Google’s suppliers to work to make Google better — what is SEO but a collective effort by basically the entire Internet to ensure that Google’s search engine is as good as possible? — which attracts more consumers, which drives suppliers to work even harder in a virtuous cycle. Meanwhile, Google is collecting information from all of those consumers, particularly what results they click on for which searches, to continuously hone its accuracy and relevance, making the product that much better, attracting that many more end users, in another virtuous cycle:

One of the central ongoing projects of this site has been to argue that this phenomenon, which I call Aggregation Theory, is endemic to digital markets. From the original Aggregation Theory Article:

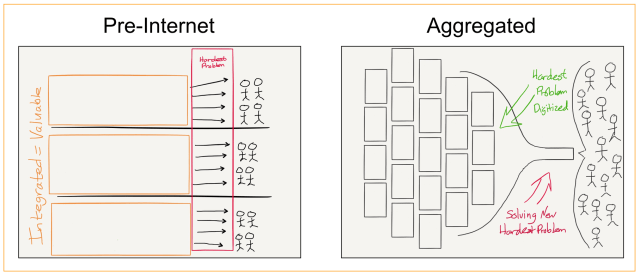

The value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era the latter depended on controlling distribution…Note how the distributors in all of these industries integrated backwards into supply: there have always been far more users/consumers than suppliers, which means that in a world where transactions are costly owning the supplier relationship provides significantly more leverage.

The fundamental disruption of the Internet has been to turn this dynamic on its head. First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

This has fundamentally changed the plane of competition: no longer do distributors compete based upon exclusive supplier relationships, with consumers/users an afterthought. Instead, suppliers can be commoditized leaving consumers/users as a first order priority. By extension, this means that the most important factor determining success is the user experience: the best distributors/aggregators/market-makers win by providing the best experience, which earns them the most consumers/users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.

In short, increased digitization leads to increased centralization (the opposite of what many originally assumed about the Internet). It also provides a lot of consumer benefit — again, Aggregators win by building ever better products for consumers — which is why Aggregators are broadly popular in a way that traditional monopolists are not.

Unfortunately, too many antitrust-focused critiques of tech have missed this essential difference. I wrote about this mistake in Where Warren’s Wrong:

Perhaps it is best for Senator Warren’s argument that her article never does explain how these companies became so big, because the reason cuts at the core of her argument: Google, Facebook, Amazon, and Apple dominate because consumers like them. Each of them leveraged technology to solve unique user needs, acquired users, then leveraged those users to attract suppliers onto their platforms by choice, which attracted more users, creating a virtuous cycle that I have christened Aggregation Theory.

Aggregation Theory is the reason why all of these companies have escaped antitrust scrutiny to date in the U.S.: here antitrust law rests on the consumer welfare standard, and the entire reason why these companies succeed is because they deliver consumer benefit.

The European Union does have a different standard, rooted in a drive to preserve competition; given that the virtuous cycle described by Aggregation Theory does tend towards winner-take-all effects, it is not a surprise that Google in particular has faced multiple antitrust actions from the European Commission. Even the EU standard, though, struggles with the real consumer benefits delivered by Aggregators.

Consider the Google Shopping case: Google was found guilty of antitrust violations in a case brought by a shopping comparison site called Foundem, which complained about their site being buried when consumers were searching for items to buy. This complaint made no sense, as I explained in Ends, Means, and Antitrust:

If I search for a specific product, why would I not want to be shown that specific product? It frankly seems bizarre to argue that I would prefer to see links to shopping comparison sites; if that is what I wanted I would search for “Shopping Comparison Sites”, a request that Google is more than happy to fulfill:

The European Commission is effectively arguing that Google is wrong by virtue of fulfilling my search request explicitly; apparently they should read my mind and serve up an answer (a shopping comparison site) that is in fact different from what I am requesting (a product)?

There is certainly an argument to be made that Google, not only in Shopping but also in verticals like local search, is choking off the websites on which Search relies by increasingly offering its own results. At the same time, there is absolutely nothing stopping customers from visiting those websites directly, or downloading their apps, bypassing Google completely. That consumers choose not to is not because Google is somehow restricting them — that is impossible! — but because they don’t want to. Is it really the purview of regulators to correct consumer choices willingly made?

Not only is that answer “no” for philosophical reasons, it should be “no” for pragmatic reasons, as the ongoing Google Shopping saga in Europe demonstrates. As I noted last December, the European Commission keeps changing its mind about remedies in that case, not because Google is being impertinent, but because seeking to undo an Aggregator by changing consumer preferences is like pushing on a string.

Regulating Aggregators

The solution, to be clear, is not simply throwing one’s hands up in the air and despairing that nothing can be done. It is nearly impossible to break up an Aggregator’s virtuous cycle once it is spinning, both because there isn’t a good legal case to do so (again, consumers are benefitting!), and because the cycle itself is so strong.

What regulators can do, though, is prevent Aggregators from artificially enhancing their natural advantages. From A Framework for Regulating Competition on the Internet:

Aggregators are different. Yes, they provide value to end users and to third-parties, at least for a time, but the incentives are warped from the beginning: 3rd-parties are not actually incentivized to serve users well, but rather to make the Aggregator happy. The implication from a societal perspective is that the economic impact of an Aggregator is much more self-contained than a platform, which means there is correspondingly less of a concern about limiting Aggregator growth.

Given that Aggregator power comes from controlling demand, regulators should look at the acquisition of other potential Aggregators with extreme skepticism. At the same time, whatever an Aggregator chooses to do on its own site or app is less important, because users and third parties can always go elsewhere, and if they don’t, that is because they are satisfied.

Here Facebook is a useful example: the company’s competitive position would be considerably shakier — and the consumer ad-supported ecosystem considerably healthier — if it had not acquired Instagram and WhatsApp, two other consumer-facing apps. At the same time, Facebook’s specific policies around what does or does not appear on its apps, or how it organizes its feed, has no reason to be a regulatory concern; I would argue the same thing when it comes to Google’s search results.

This same principle applies to contracts; from Where Warren’s Wrong:

Aggregators already have massive structural advantages in their value chains; to that end, there should be significantly more attention paid to market restrictions that are enforced by contracts.

Go back to Microsoft: in my estimation the most egregious antitrust violations committed by Microsoft were the restrictions placed on OEMs, both to ensure the installation of Internet Explorer as well as to suppress alternative operating systems. These were not violations rooted in market dominance, at least not directly, but rather contracts that OEMs could not afford to say ‘No’ to.

This is an area where the European Commission has gotten it right with regard to Google: as a condition of access to Google apps, most critically the Play Store, OEMs were prohibited from selling any phones with Android forks. This is a restriction on competition produced not by market dominance, at least not directly, but rather contracts that OEMs could not afford to say ‘No’ to.

This is also the issue with Apple’s App Store: the restriction on linking to a website for purchasing an ebook or subscribing to a streaming service is not rooted in any sort of technical limitation; rather, it is an arbitrary rule in the App Developer Agreement enforced by Apple’s App Review team. It has nothing to do with consumer security, and everything to do with Apple’s bottom line.

This is an area ripe for enhanced antitrust enforcement: these large tech companies have enough advantages, most of them earned through delivering what customers want, and abetted by the fundamental nature of zero marginal costs. Seeking to augment those advantages through contracts that suppliers can’t say ‘No’ to should be viewed with extreme skepticism.

This is exactly why I am so pleased to see how narrowly focused the Justice Department’s lawsuit is: instead of trying to argue that Google should not make search results better, the Justice Department is arguing that Google, given its inherent advantages as a monopoly, should have to win on the merits of its product, not the inevitably larger size of its revenue share agreements. In other words, Google can enjoy the natural fruits of being an Aggregator, it just can’t use artificial means — in this case contracts — to extend that inherent advantage.

Google’s Defense

Of course the fact that the Justice Department is focused on the correct issue with Google Search does not mean this lawsuit will be successful. Google’s defense is fairly straightforward.

First, Google will argue that its deals do not represent lock-in; users can change the default search option for the vast majority of touch points that Google pays for, and the fact they choose not to is because Google’s search is better. This last point is why the Justice Department took pains to emphasize the importance of data in improving search engine performance, because to the extent that is true, it means it is impossible for alternative search engines to catch up.

Second, Google will argue that its deals on non-Google platforms (i.e. Apple platforms and rival browsers) were because Google was willing to pay more than the competition, which is not only the open market at work, but also means that the associated products can be offered at a lower price or even for free. Here again the Justice Department is relying on a scale argument: Google’s monopoly in search means it has a monopoly in search advertising, which means it can afford to outbid all of its rivals.

Third, Google will argue that its deals for Android distribution and the tying of search defaults to Google Play Services (including the Play Store) is not only pro-consumer in its benefits, including free services, less fragmentation, and a larger market for apps, but is also Google’s just reward for having invested in the creation of Android. This last argument didn’t work in front of the European Commission, but it may be more effective before a U.S. judge. The Justice Department, meanwhile, probably has the strongest case on this point: sure, Google created Android, but it also made the choice to open source it, and if its attempts to re-seize control through blatant tying aren’t illegal then it’s hard to imagine what could be.

Google and Apple

There is, though, one more complicating factor: the weird dynamics of Google’s relationship with Apple. From the lawsuit:

Google has had a series of search distribution agreements with Apple, effectively locking up one of the most significant distribution channels for general search engines. Apple operates a tightly controlled ecosystem and produces both the hardware and the operating system for its popular products. Apple does not license its operating systems to third- party manufacturers and controls preinstallation of all apps on its products. The Safari browser is the preinstalled default browser on Apple computer and mobile devices. Apple devices account for roughly 60 percent of mobile device usage in the United States. Apple’s Mac OS accounts for approximately 25 percent of the computer usage in the United States…

Apple has not developed and does not offer its own general search engine. Under the current agreement between Apple and Google, which has a multi-year term, Apple must make Google’s search engine the default for Safari, and use Google for Siri and Spotlight in response to general search queries. In exchange for this privileged access to Apple’s massive consumer base, Google pays Apple billions of dollars in advertising revenue each year, with public estimates ranging around $8–12 billion. The revenues Google shares with Apple make up approximately 15–20 percent of Apple’s worldwide net income.

Although it is possible to change the search default on Safari from Google to a competing general search engine, few people do, making Google the de facto exclusive general search engine. That is why Google pays Apple billions on a yearly basis for default status. Indeed, Google’s documents recognize that “Safari default is a significant revenue channel” and that losing the deal would fundamentally harm Google’s bottom line. Thus, Google views the prospect of losing default status on Apple devices as a “Code Red” scenario. In short, Google pays Apple billions to be the default search provider, in part, because Google knows the agreement increases the company’s valuable scale; this simultaneously denies that scale to rivals.

What is fascinating about this relationship is the number of ways in which this can be interpreted. From one perspective, the fact that Google has to pay so much to Apple is evidence that there is competition in the market. From another perspective, the fact that Apple can extract so much money from Google is evidence that it is Apple that has monopoly-like power over its value chain. A third perspective — surely the one endorsed by the Justice Department — is that the fact that Google values the default position so highly is ipso facto evidence that default position matters.

I suspect the true answer is a mixture of all three, with a dash of collusion. The lawsuit notes:

Apple’s RSA incentivizes Apple to push more and more search traffic to Google and accommodate Google’s strategy of denying scale to rivals. For example, in 2018, Apple’s and Google’s CEOs met to discuss how the companies could work together to drive search revenue growth. After the 2018 meeting, a senior Apple employee wrote to a Google counterpart: “Our vision is that we work as if we are one company.”

This gets at a larger problem in many tech markets: the tendency towards duopoly, which often lets one company cover for the other acting anti-competitively. In the case of Apple and Google:

- Android’s presence in the market means that Apple can act anticompetitively with its App Store policies (which Google is happy to ape).

- Apple’s privacy focus justifies decisions like limiting trackers, restricting cookies, and cutting off in-app analytics; Google happily follows Apple’s lead, which impacts its advertising rivals far more than it does Google, improving their relative competitive position.

- Apple earns billions of dollars giving its customers the best default search experience, even as that ensures that Google will remain the best search engine (and raises questions about the sincerity of Apple’s privacy rhetoric).

This isn’t the only duopoly: Google and Facebook jointly dominate digital advertising, Microsoft and Google jointly dominate productivity applications, Microsoft and Amazon jointly dominate the public cloud, and Amazon and Google jointly dominate shopping searches. And, while all of these companies compete, those competitive forces have set nearly all of these duopolies into fairly stable positions that justify cooperation of the sort documented between Apple and Google, even as any one company alone is able to use its rival as justification for avoiding antitrust scrutiny.

Anti-Aggregation

After the House Antitrust Committee released its report on the tech industry I wrote that it was important to distinguish between Anti-monopoly and Antitrust:

That, though, is why it is a mistake to read the report as some sort of technocratic document. There are, to be sure, a lot of interesting facts that were dug up by the committee, and some bad behavior, which may or may not be anticompetitive in the legal sense. Certainly the companies would prefer to have a legalistic antitrust debate, for good reason: it is exceptionally difficult to make the case that any of these companies are causing consumer harm, which is the de facto standard for antitrust in the United States. Indeed, what makes Google’s contention that “The competition is only a click away” so infuriating is the fact it is true.

What matters more is the context laid out by Letwin: there is a strain of political thought in America, independent of political party (although traditionally associated with Democrats), that is inherently allergic to concentrated power — monopoly in the populist sense, if not the legal one.

Hatred of monopoly is one of the oldest American political habits and like most profound traditions, it consisted of an essentially permanent idea expressed differently at different times. “Monopoly”, as the word was used in America, meant at first a special legal privilege granted by the state; later it came more often to mean exclusive control that a few persons achieved by their own efforts; but it always meant some sort of unjustified power, especially one that raised obstacles to equality of opportunity.

In other words, this subcommittee report is simply a new expression of an old idea; the details matter less than the fact it exists.

This is going to be a critical sentiment to keep in mind as this case unfolds. If I had to bet on an outcome, I would bet on Google winning. Apple and everyone else are free to enter into whatever contracts they wish, and consumers are free to undo the defaults that flow from those contracts. Where is the harm?

Google, of course, wants the conversation to stop there: as long as the argument is a legal one, or even an economic one, Aggregators have powerful justifications for their dominance. That, though, is why the real question is a political one: are we as a society comfortable with a few big companies having such an outsized role in our lives? If the answer is no, the ultimate answer will not be through the courts, but through new laws for a new era. Anti-aggregation, not antitrust.