Venture Capital

-

Silicon Valley Bank bears responsibility for its demise, but it symbolizes a Silicon Valley reality that is very different from the myth — and the ultimate cause is tech itself.

-

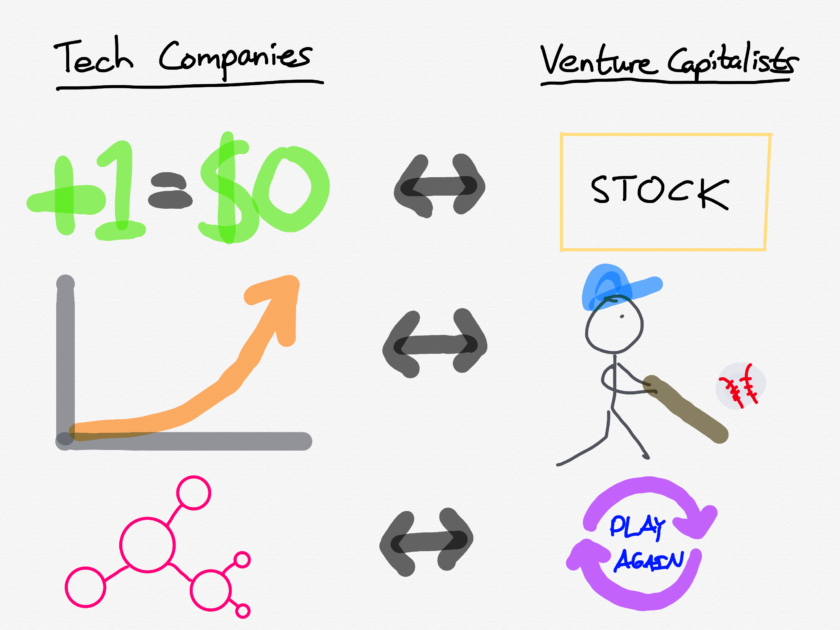

Uber represents something new: a company that is different than incumbents because of technology, yet not itself a tech company — just like the Venture Fund is not a VC.

-

Venture Capital has been transformed by a surprising source: Amazon. Ultimately, no industry is safe from the impact of the Internet.

-

An Interview with Vercel Founder Guillermo Rauch

An interview with Vercel Founder Guillermo Rauch about Next.js, Vercel, and building the front-end cloud.

-

An Interview with Replika Founder and CEO Eugenia Kuyda

An interview with Replika founder and CEO Eugenia Kuyda about relationship AI, what actually matters for consumers when it comes to chatbots, and the Replika risks and risqué.

-

The End of Silicon Valley (Bank)

Silicon Valley Bank bears responsibility for its demise, but it symbolizes a Silicon Valley reality that is very different from the myth — and the ultimate cause is tech itself.

-

An Interview With Babylist Founder and CEO Natalie Gordon

An interview with Babylist founder and CEO Natalie Gordon about Babylist’s founding, her growing ambition, and why the company is a shining example of Aggregation Theory in action.

-

iPhone Production Site Locked Down, An Interview With Bill Bishop about China (and Substack)

An Interview With Bill Bishop about China’s COVID outbreak, the Ukraine war, and Substack

-

More on Substack, Faceless Publishers and ATT, Apple’s ATT Deliberations

More on Substack, and how they have done right by publishers, and why their approach may be essential in a post-ATT world.

-

Substack Launches App, Substack and the Four Bens, In-App Purchase and the Substack Bundle

Substack launched an app, which isn’t a surprise given their VC model, but which portends change all the same.

-

Microsoft Earnings, Microsoft Advertising, The Deflating Balloon

Microsoft had great earnings, but had to reassure investors all the same. Plus, new advertising efforts, and why shrinking private valuations help Redmond.